How to use “Buy Now, Pay Later” payment methods with Flodesk Checkout

In this article, we'll guide you through the benefits, setup, and management of using Buy Now, Pay Later (BNPL) payment methods with Flodesk Checkout.

Ever found something you really wanted but didn’t want to pay the full price upfront? That’s where Buy Now, Pay Later (BNPL) comes in!

With BNPL, you can allow buyers to get your offer today and pay for it over time—usually in smaller, interest-free payments. It’s like splitting the cost into easy chunks instead of paying all at once.

How to enable BNPL in Flodesk Checkout

Important: Buy Now, Pay Later payment methods are only available if you have migrated your Flodesk Checkout to Stripe Standard and you operate from a country that allows any of these BNPL payment providers:

Klarna

Afterpay

Affirm

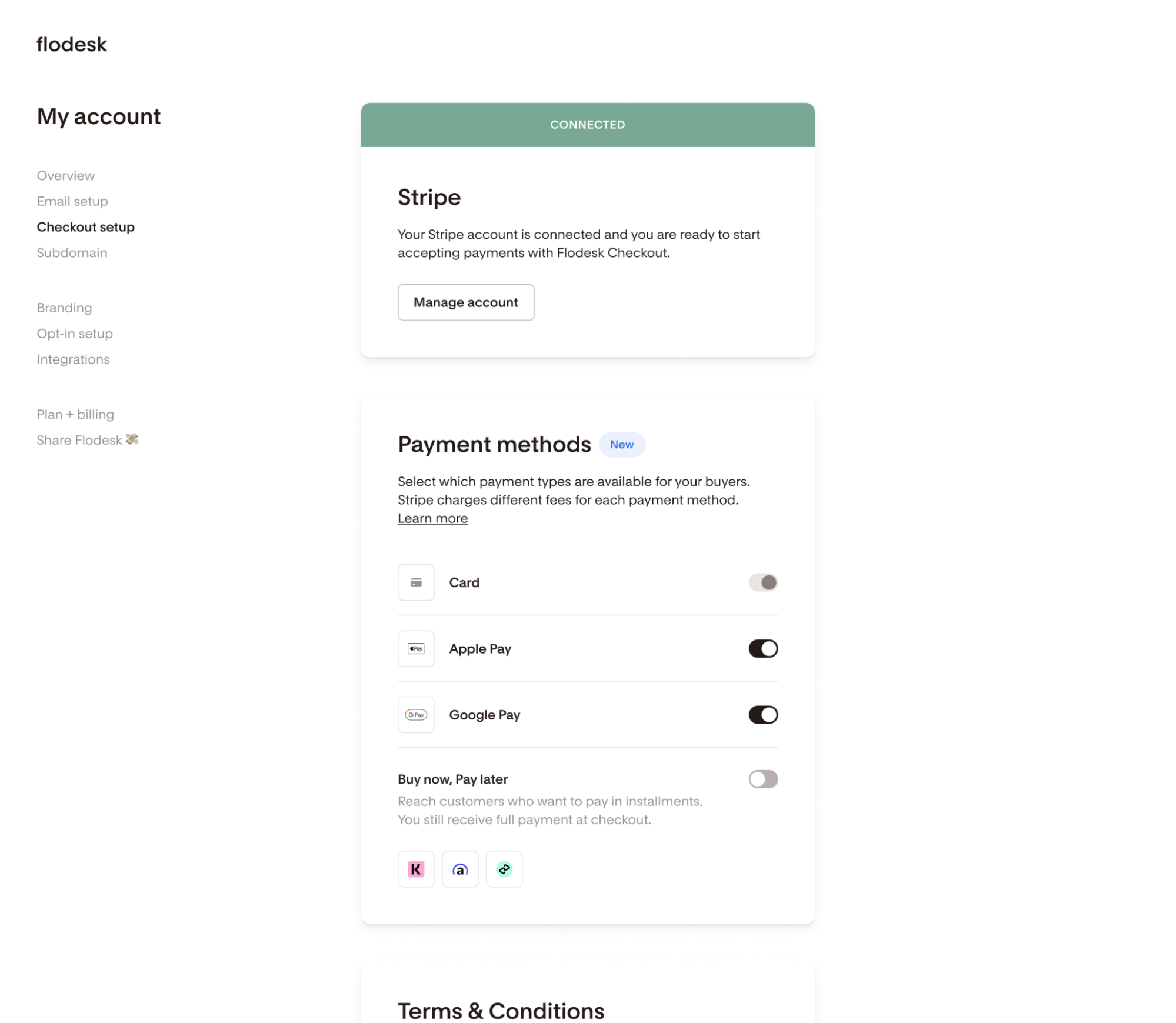

Step 1. Go to Account Settings > Checkout setup

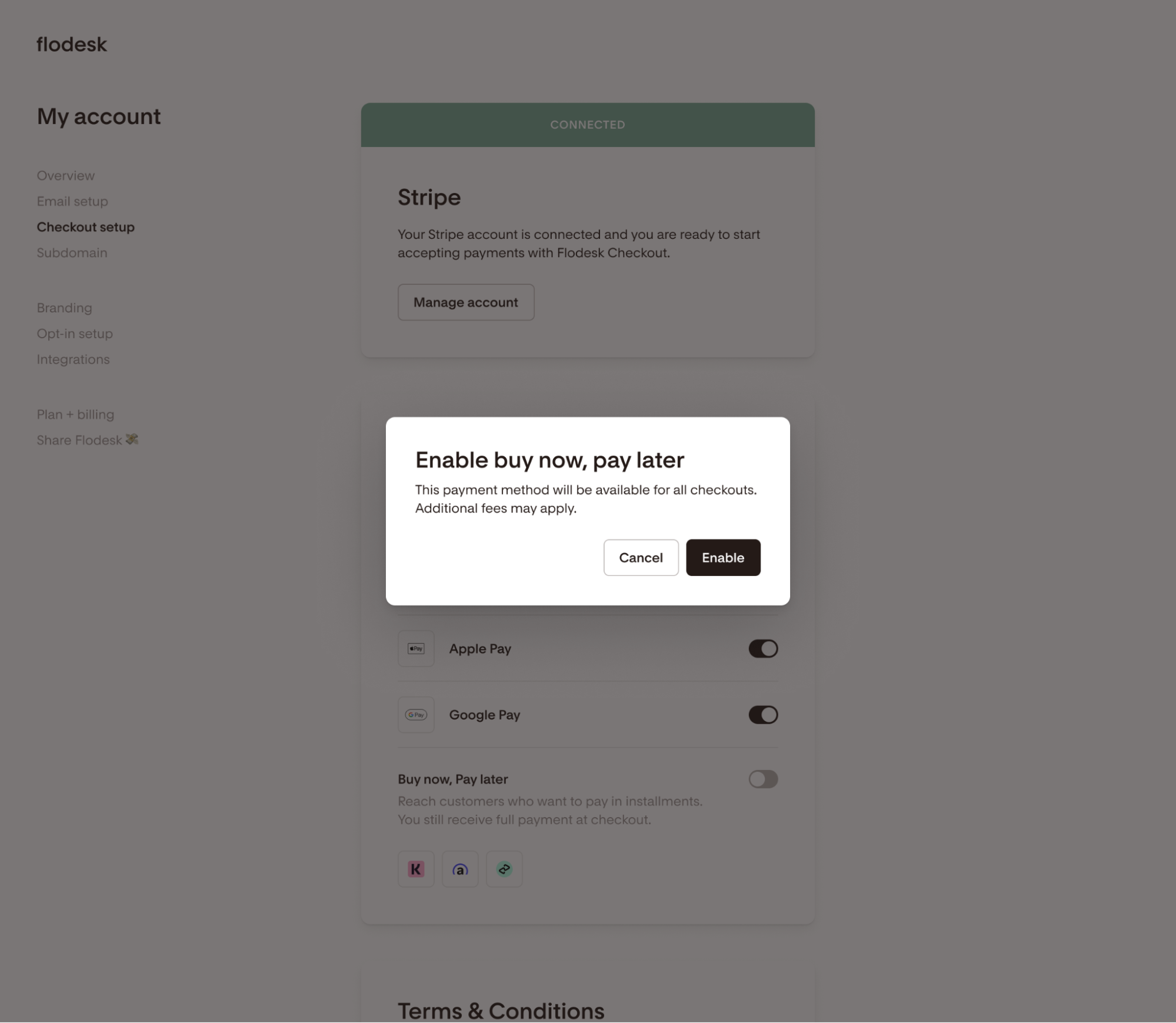

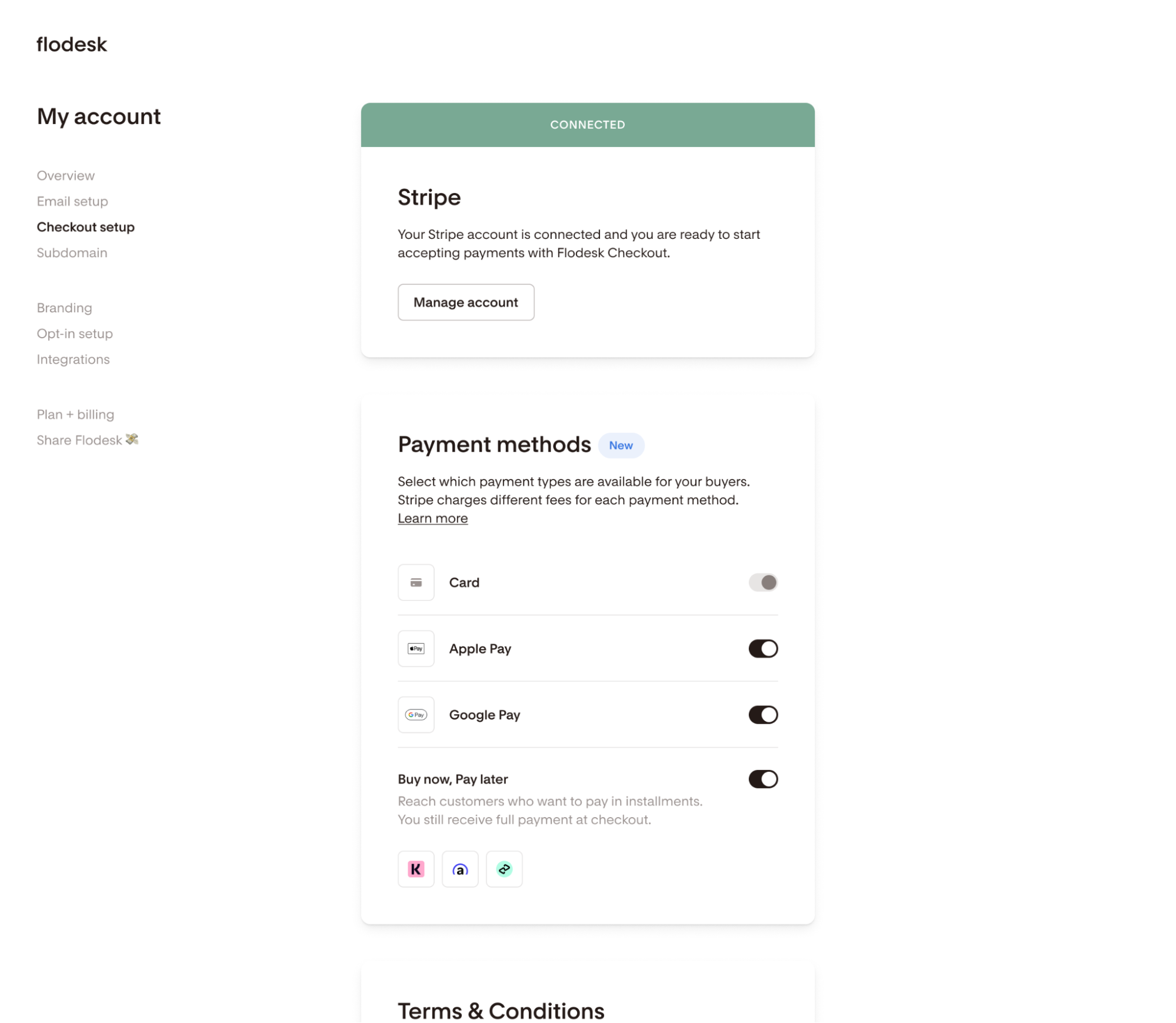

Step 2. On the Payment methods card, toggle on the BNPL option. This will automatically enable all available BNPL payment methods for your Flodesk Checkouts.

Important: If after turning on the toggle in Flodesk, you don't see the BNPL methods in your Checkout, you need to go to your Stripe dashboard Settings > Payments > Payment Methods and 'Turn On' the relevant payment method within Stripe itself.

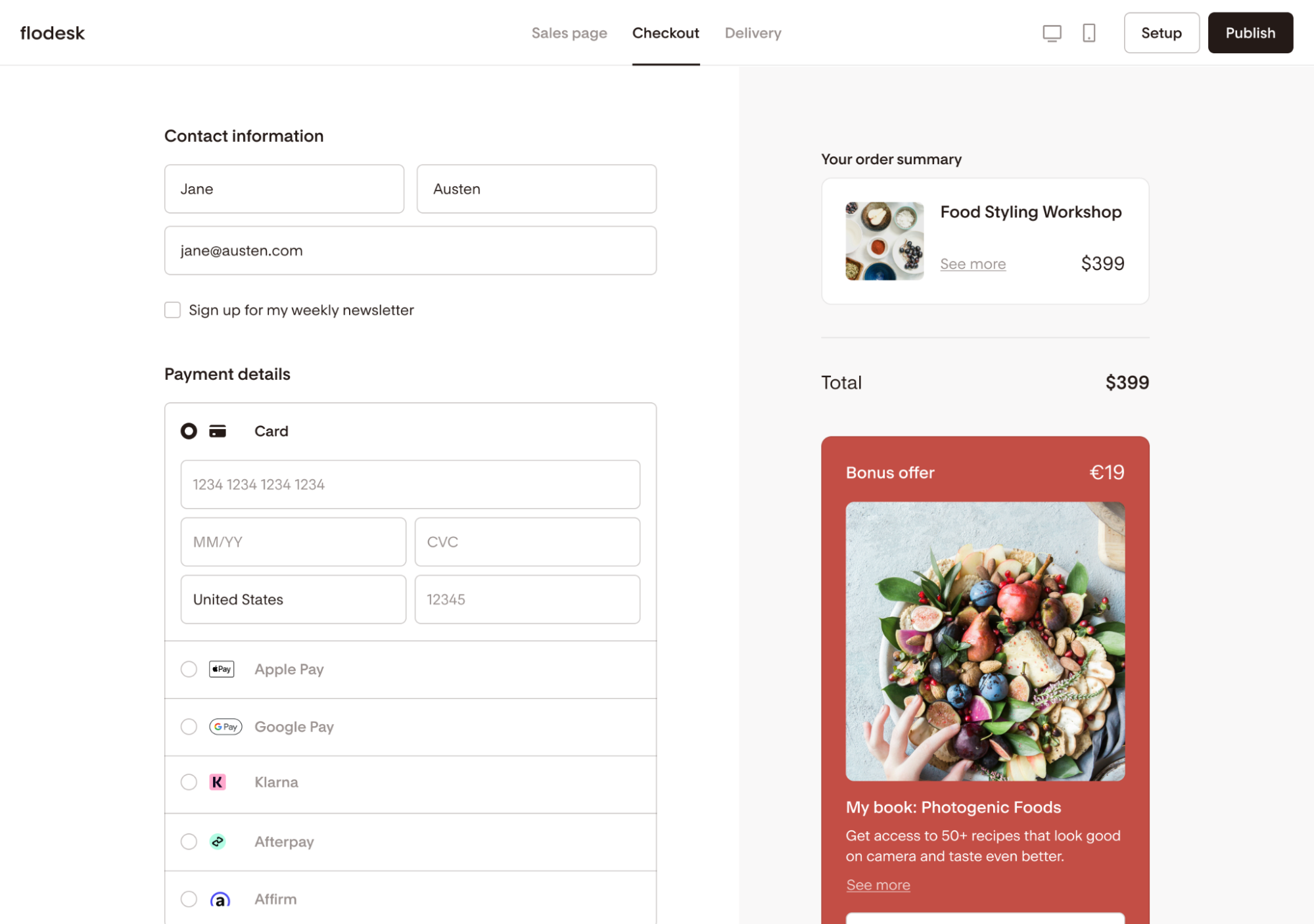

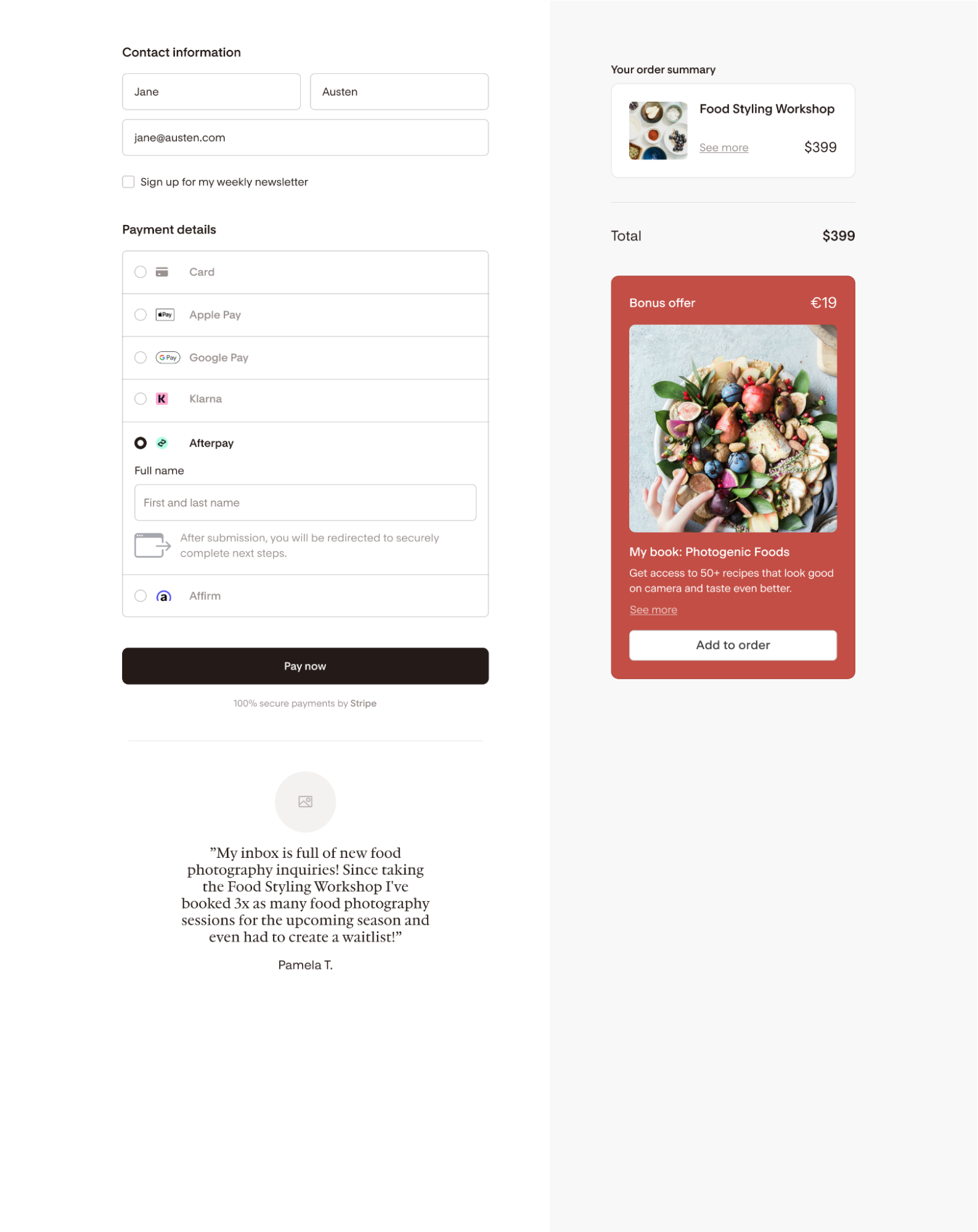

Now, when you create a new checkout or edit an existing one, all the above payment methods will be available, similar to the example below if you operate from a country that allows any of these BNPL payment providers:

If your buyer is from a supported location, they can complete the checkout by selecting payment through:

Card

Apple Pay

Google Pay

Klarna

Afterpay

Affirm

Note: Learn more about where BNPL is available here.

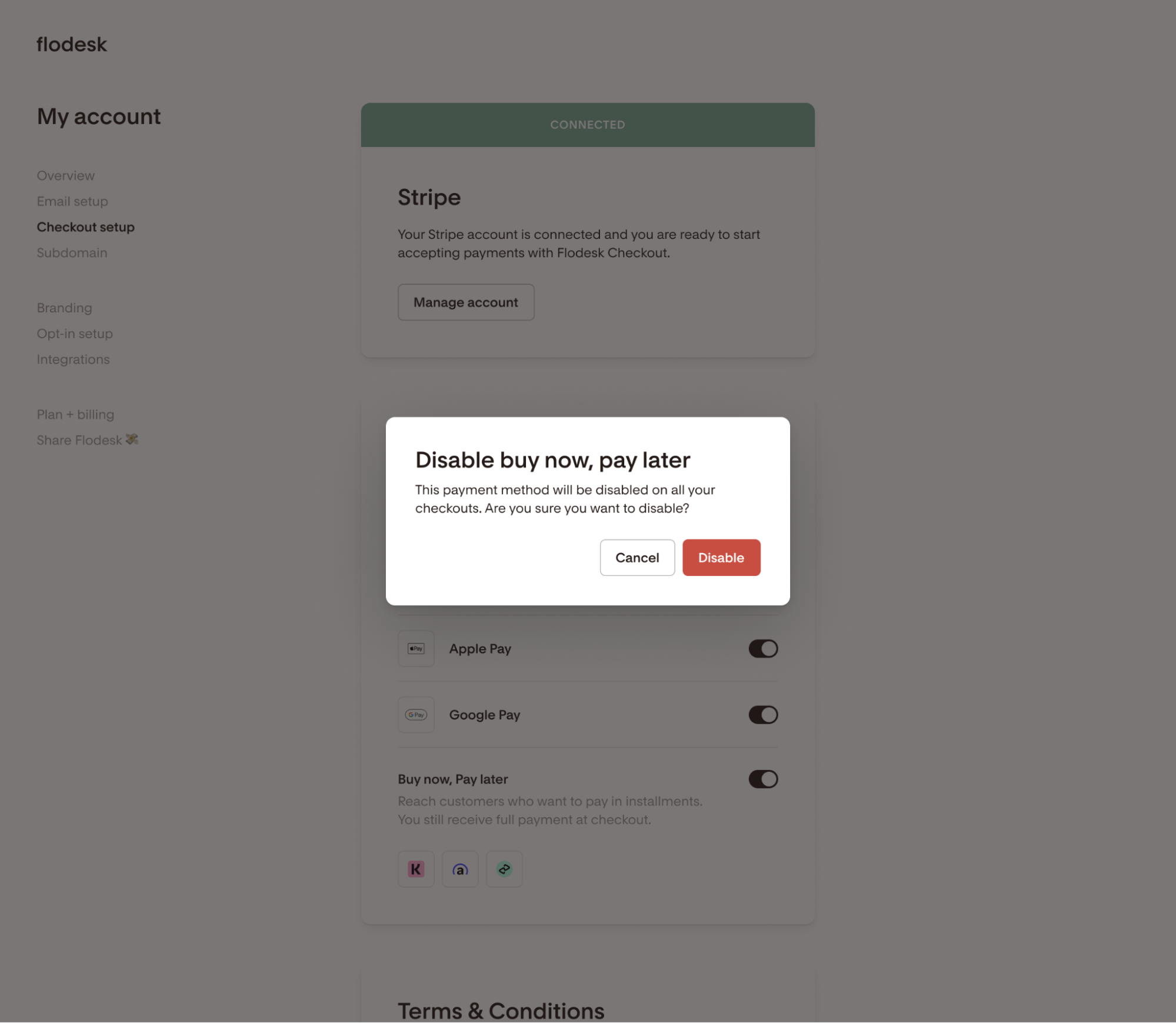

How do I disable BNPL?

Step 1. Go to Account Settings > Checkout setup

Step 2. On the Payment methods card, toggle off the BNPL option. This will automatically remove all available BNPL payment methods from your Flodesk Checkouts.

Note: If you want to disable only a specific BNPL payment method, for example, Klarna, you need to do that through your Stripe Dashboard.

1. Log in to your Stripe account

2. Navigate to Settings > Payments > Payment Methods > Flodesk Configuration

3. Select the payment method you wish to disable and click Turn off

Through your Stripe dashboard, you can also control the price minimum and maximum you allow for each BNPL payment method. For example, you can set a minimum price of 1,000 USD, and then your Checkouts only show BNPL payment methods as an option for customers if the product costs at least 1,000 USD. For offers below this price minimum, BNPL will be hidden.

Is BNPL allowed for all Business Types?

BNPL may not be allowed, depending on your business type. Please review the global payment availability for Stripe here.

BNPL is restricted for certain businesses by Stripe & the BNPL provider:

Business to business services

Home improvement services, including contractors and special trade contractors

Titled goods and auto loans, including entire cars, boats, and other motor vehicles (parts and services allowed)

Professional services (including legal, consulting, and accounting)

NFTs

Pre-orders

Alcohol

Donations

Pre-orders

NFTs

B2B

Charities

Political organizations, parties, or initiatives

B2B

Benefits of BNPL payment methods for You, as the merchant

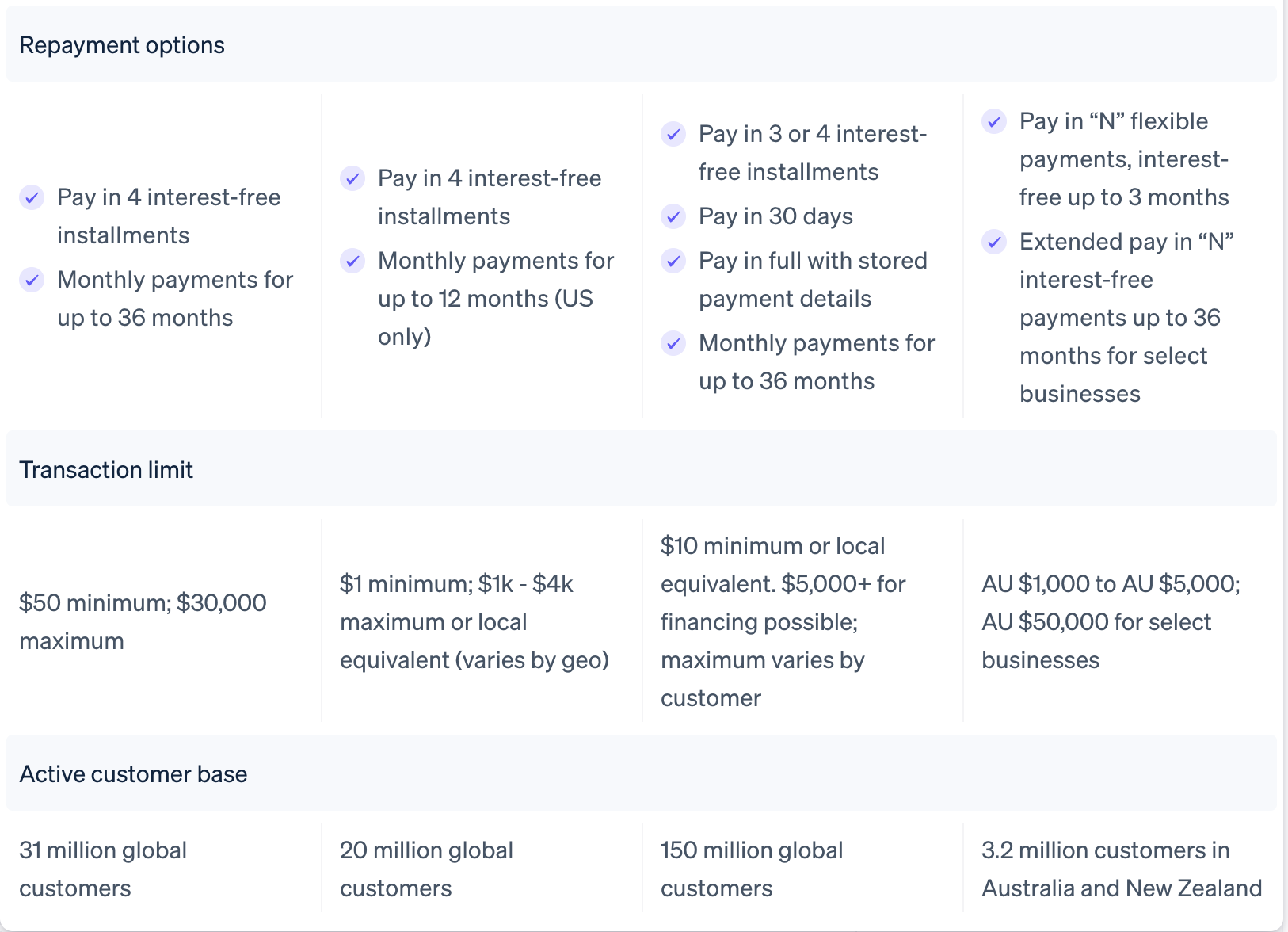

Although most of these payment methods charge you 5.99% +$0.30, offering BNPL at checkout could be a game-changer for your business because it can mean:

More sales – Customers are more likely to buy when they don’t have to pay everything upfront.

Bigger purchases – Shoppers feel more comfortable spending more when they can spread payments out.

Fewer abandoned carts – People don’t leave items behind because of price concerns.

A notable benefit to BNPL is that you receive 100% of the net transaction amount (net of processing fees) when the buyer completes their purchase.

Why your buyers will love Buy Now, Pay Later

For buyers, BNPL makes shopping easier by:

Making big buys more affordable – Pay over time instead of all at once.

Avoiding high-interest debt – Many BNPL plans don’t charge interest if payments are made on time.

Adding flexibility – No need to wait until payday to grab what you want!

When your customers make a one-time purchase, they simply select a buy now, pay later provider in the payment form (in the below example, it’s Afterpay) and are redirected to the provider’s site or app to create an account or log in.

Customers then choose whether to accept the repayment plan terms—typically selecting bi-weekly or monthly installments—and complete the purchase.

Can a BNPL order be refunded?

If you need to refund a BNPL order, go to your Stripe dashboard to locate the transaction and initiate the refund process.

Most BNPL cancels any remaining payments on a refunded charge and returns the already-paid amount to the customer: